Manpasand Beverages is a non alcoholic beverages company which caters to the "Juice" beverages industry with its brand "Mango Sip". It has entered the market in 2010 and it believes in two years has acquired a decent market share of 4% of the total Juice Industry in India. It filed a DRHP with the SEBI on November 26th indicating its interest for listing.

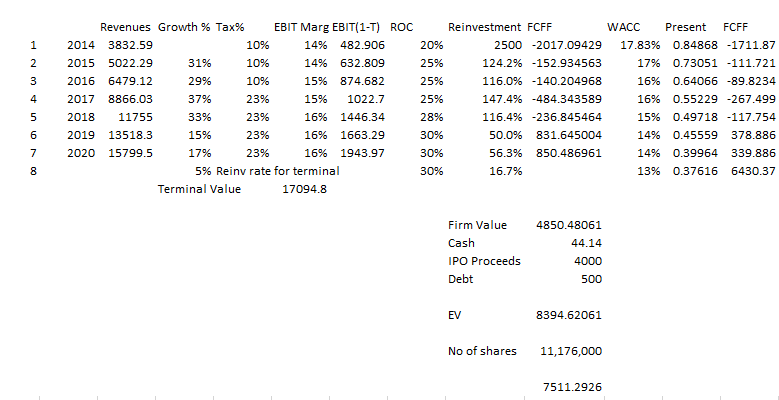

I have valued the company post IPO factoring the Rs 4000 Million it plans to obtain through the IPO. I have stated my assumptions and the steps to value the company below. The valuation is available in this file which you can download while I take you through it.

- Discount Rate- The discount rate is split into Cost of Debt and Cost of Equity. According to the DRHP, the loans they have taken from the bank have come at a cost of bank rate+350 bps. I have assumed the same as the cost of debt as the interest coverage ratio is high and I do not see any reason for banks to increase the cost of debt later. The bank rate is 9% right now which adds up the cost of debt to 12.5%. For the cost of equity, valuing beta was tough as there's no other comparables in the market, the big competitors Coke and Pepsi are unlisted in India, the small ones like Parle's Frooti are unlisted or have a lot of other businesses from which . So I took the average unlevered beta for beverages in the US market which is 1.24. The current long term debt is Rs 261.32 million and the equity the firm is going to obtain from the IPO is Rs 4000 Million. This gives a D/E ratio of 93.8% equity to total

- The Industry overview section gives the analysis of an EuroMonitor report that predicts the future market value of the beverages industry and also the contribution of juice industry. Due to lack of better data, and to keep things simple, I will assume that the revenues projected in the report are a good measure. Out of this in the past 2 years, Manpasand Beverages has had a market share of 4.8%. I have assumed that Manpasand will slowly increase the market share in the fruits segment and will acquire 8.5% by 2020. This is because Manpasand has been increasing the portfolio products with products such as "Mango ORS". If you believe that it will not be able to sustain such a market share in such a competitive market change the values accordingly

- The Growth inherently came from the increase in the market share of the Juice segment. The Juice segment had a CAGR of 18%. I have assumed that by 2020 the market share will stabilise at 8.5% . I have assumed that the industry will keep growing at the rate of 5% accounting for India's high inflation state which I have incorporated into terminal growth.

- The EBITDA margins in 2013 and 2014 are around 15.5%. I have taken the same margins for all the years starting with 14% in 2014 and slowly increasing the margins to 16% by 2020

- The average ROC was a factor necessary for forecasting reinvestment. Since there were no comparables I took up Marico and saw its ROC shift around 28-35%. So in the initial years, I assumed an ROC of 20% which matched the reinvestment in the previous years and slowly took it up to 30% gradually.

- Looking at the valuation, Firm Value is Rs 8394 Mil. Adding cash of Rs 44.14 Million and IPO proceeds of Rs 4000 Million, removing the debt of Rs 500 Million, the Enterprise Value is Rs 19,928 Million. Dividing by the number of shares of 11,176,000 the value of each share is Rs 7511

- After finding out the dilution, this Enterprise value can be used to find out to find out the price per share and then decide if the price is a good deal before buying into it.

You can change values in the valuation sheet I have attached to make sure you come to a price based on the assumptions you are comfortable with by playing around with the valuation sheet.

Here's the FCFF calculation attached as an image

No comments:

Post a Comment