VRL Logistics is a travel company that has two major sources of Revenue

- Parcel Delivery Services that contribute to about 75% of its Revenues

- Bus Travel Services that contribute to about 25% of its Revenues

VRL logistics has been growing at a CAGR of 20% in the last 4 years but its growth has slowed down in the past due to less demand of deliveries from the Industry because of slow growth. It has been seeing a growth of 7-8% in the past two years

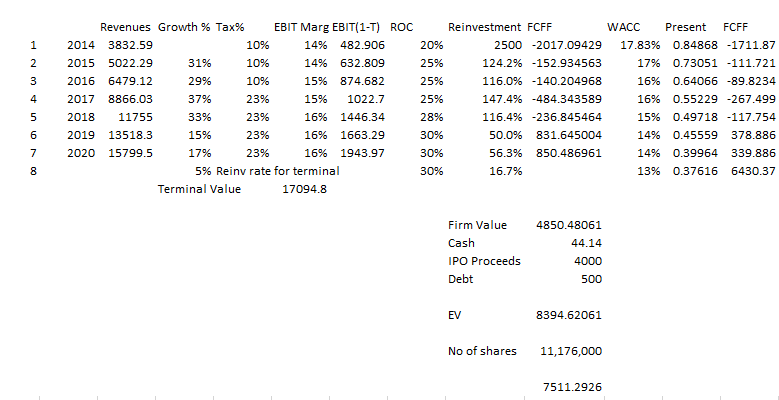

My valuation for the company can be found here where you can download and change the numbers if you believe in a story that is different from mine for the company. All numbers are in INR Million

- WACC- I found the cost of debt taking a weighted average of all the loans and the rate of interest they were taken at. The weighted cost of debt came to be 13.2%. I took the average beta of the 10 transportation companies in India which was 1.1. The risk free rate is 8%(Present 10 yr government bond yield) and the equity risk premium is 8.3% (Using ERP=CDS*Std Dev of Equity Market/Std Dev of Bond Market| CDS=2.3% Multiplier =1.5 Mature Market Risk Premium =5%) WACC came to 13.72% which I increased slowly to 15% at the terminal value because I expect an increase in equity value

- Revenues- I have assumed that the revenues keep growing at the same rate of 8-9% , the analysts estimates in the growth rates of logistics sector are around 10% because of muted growth of Industrial Production. These increase in revenues have to be backed by reinvestment rates

- EBIT Margins- Historically, the EBIT margins have been 13%-14% so I used the same margins, I have increased the margins for the next year to 16% because of decrease in its primary cost- fuel.

- Reinvestment- I ran a regression on the Revenues vs Number of transportation vehicles in the past. I then extrapolated this regression to the number of buses that should be increased in case of the expected increase in revenues. Right now, VRL is using Rs 831 Million to purchase 350 new goods transportation vehicles. So using this as a background figure I calculated the reinvestment and added a 5% of the EBIT(1-T) as reinvestment for repairs/upgrades/warehousing upgrades. The reinvestment rate I have used is 40% on average and 35% at the terminal value.

- Terminal Growth - I calculated the terminal value with a 6% growth rate and a reinvestment rate of 35%

- To the operating value, I added the IPO Proceeds, added cash and subtracted the debt to get an enterprise value. The existing number of shares are 85,536,162 which gave a value per share of Rs 187.55

So depending on the increase in number of shares, the value per share would be increased which you can change on the excel sheet to calculate the intrinsic value per share to decide on if you should buy into the IPO